10 Best MedTech Startups Revolutionizing Healthcare

If you’re trying to make sense of what’s really changing healthcare today, look beyond hospitals and pharmaceutical giants. The real action is happening in smaller, faster-moving teams. MedTech startups are using technology to rethink how healthcare works altogether.

But what connects the most impactful startups is their ability to solve real, clinical problems. Problems that legacy systems have either overlooked or accepted as too complex to fix.

These startups are addressing core challenges like reducing diagnostic errors, improving treatment adherence, making care accessible in remote areas, or speeding up drug development cycles.

They’re tackling gaps in the system that clinicians, patients, and even insurers feel every day.

In this article, we’ll look at 10 MedTech startups that are doing this well. Companies that are demonstrating strong product-market fit, clinical relevance, and a clear path to scale. We’ll also explore how MedTech startups are different from traditional healthcare companies and where this space is headed.

The Rise of MedTech Startups

Ask anyone who’s worked inside a hospital system or a health insurance company—healthcare moves slowly. But illness doesn’t wait, and neither do patients. That disconnect has created space for startups to do what institutions can’t, solve specific problems with speed, focus, and technology that’s actually usable.

The rise of MedTech startups has been around for a while. But the real shift is that clinical teams are now more willing to adopt external solutions, especially those that ease workload or improve accuracy.

Startups have responded by building products that plug into real workflows, not just flashy prototypes for demo day.

Regulation, which is often blamed for slowing innovation, is changing too. The FDA’s digital health guidance and Europe’s MDR processes are still cautious but clearer than before.

Selection Criteria for Top MedTech Startups

Not every healthcare startup qualifies as a MedTech company, and even fewer are truly innovating. For this list, we didn’t only look at who raised the most money or got the most press. We looked for startups that meet four practical, grounded criteria:

Clinical Relevance

Is the startup addressing a real, high-impact problem in healthcare? This could mean improving diagnostic accuracy, enhancing surgical precision, or increasing patient access to care.

Technical Maturity

A promising idea is one thing, but to have the product validated in real-world settings is another game altogether. We looked for companies that have moved past early prototyping and have clinical trials, regulatory clearance, or active deployments to show for it.

Scalability

We also considered whether the product works beyond one hospital or region. Healthcare is fragmented, and a solution that only fits one system won’t go far.

So, we were only convinced by startups that build modular, integrable, or platform-based solutions that can scale across markets and geographies.

Trajectory

We also checked partnerships, revenue models, and team composition. Startups that understand the complexities of healthcare distribution (like provider adoption, payer incentives, and compliance) will always have an edge.

10 Best MedTech Startups Revolutionizing Healthcare

Many build for novelty, but a few build for impact. In selecting these startups, we looked at whether the problem is clinically meaningful, whether the solution is technically and commercially viable, and also if the team is showing signs of traction like regulatory progress, deployments, strong partnerships, or sustainable revenue.

1. Ignota Labs

Ignota is tackling a huge inefficiency in pharma—failed drugs.Their platform uses AI to identify safety flaws in compounds that didn’t make it to market and re-engineers them for reuse. It’s drug repurposing at speed and scale, and it could dramatically cut R&D costs.

- AI-first drug salvage platform

- Targets <$1M cost, <2 yrs timeline

- $6.9M seed raised in 2025

- Backed by AIX, Montage

2. Neko Health

Founded by Spotify’s Daniel Ek, Neko Health is making full-body scanning for preventive care fast, affordable, and widely accessible. Using over 70 sensors and AI, they scan for heart issues, skin conditions, and more in under 10 minutes—with no radiation.

- 10,000+ scans complete

- $1.8B valuation (2025)

- $260M Series B round

- EU expansion, US next

3. VenoStent

VenoStent addresses a quiet crisis in dialysis care and failed fistulas. Their implantable wrap helps veins hold up under the pressure of surgery, improving outcomes for patients who depend on dialysis access to survive.

- Bioabsorbable vein wrap

- Y Combinator backed

- FDA Breakthrough Device

- Early human trials ongoing

4. Cera

Cera is one of the largest digital-first home healthcare providers in Europe. They use predictive AI to spot health deterioration early, helping patients stay out of hospitals. It’s tech-enabled elder care at scale, and it’s replacing traditional care models fast.

- 2M+ home visits/month

- AI predicts 80% of hospitalizations

- $150M raised in 2025

- Expanding across the UK & Europe

5. Hinge Health

Hinge Health delivers digital, physical therapy for joint and back pain. Through wearable sensors, app-based sessions, and remote coaches, they’ve made MSK care more accessible and less expensive, especially for employers and payers.

- 25M+ covered lives in 2024

- $390M revenue (2024)

- IPO filed March 2025

- Works with 1,250+ employers

6. CroíValve

CroíValve is solving for tricuspid regurgitation, a common but under-treated heart valve disease. Their device allows intervention without open-heart surgery, which is especially critical for elderly patients who are too sick for invasive procedures.

- Minimally invasive coaptation valve

- €14.5M EU funding

- US feasibility study in progress

- Targets 1.6M+ patients/year

7. AION Labs

AION Labs is a pharma-tech incubator backed by giants like Pfizer and AWS. They create startups that use AI to solve hard drug discovery problems, from protein folding to antibody design. It’s a new model: not just one startup but a startup generator.

- AI + wet lab integration

- Backed by Pfizer, Merck, AWS

- Created ventures like DenovAI

- Based in Rehovot, Israel

8. Butterfly Network

Butterfly built a handheld ultrasound device that plugs into a smartphone. It replaces bulky machines and brings imaging to the bedside, the ambulance, or remote clinics. It’s FDA-cleared, affordable, and already used in over 100 countries.

- Single-probe, whole-body imaging

- FDA-cleared + CE marked

- SPAC-listed in 2021

- Expanding global training programs

9. Sword Health

Sword Health offers virtual physical therapy guided by motion sensors and AI. It’s a hardware/software blend that’s proven to reduce pain and surgery referrals, targeted at employers and payers looking to lower MSK costs.

- Valued >$2B

- 50%+ surgery reduction rates

- FDA-listed digital solution

- Covers 10M+ lives globally

10. Tempus

Tempus is building a precision medicine engine powered by clinical and molecular data. Initially focused on oncology, it now spans cardiology, neuro, and rare diseases, offering AI models that help doctors personalize treatment decisions.

- 50+ petabytes of patient data

- 10K+ providers use it

- $8.1B valuation (2024)

- Expanding into drug discovery

The Future of MedTech Startups

One major shift already underway is the move from hospital-centric care to distributed care.

Startups are building tools for home monitoring, remote diagnostics, and personalized therapy plans. As populations age and clinician shortages grow, these tools will be foundational.

Although regulation will still remain a bottleneck, it’s becoming more structured. That gives startups a predictable path and, with it, investor confidence.

We’re also moving past the era of health apps with vague claims. Startups that succeed will have to demonstrate outcomes and show impact in real-world settings.

Finally, we expect to see more convergence where MedTech overlaps biotech, payers, and EHRs. The most durable startups will find ways to integrate, partner, and plug into the complexity of healthcare instead of trying to bypass it.

FAQs

What is MedTech, and why is it important?

MedTech refers to medical technologies that support diagnosis, treatment, monitoring, or prevention of disease. It includes everything from surgical tools and diagnostic imaging to AI-based software and connected devices. It’s important because it bridges clinical needs with technical capability, often where traditional systems fall short.

How are MedTech startups different from traditional healthcare companies?

Startups typically focus on a single, well-defined problem and move fast to solve it using new tech. Legacy healthcare companies often operate across many verticals and face more internal constraints. Startups can afford to be focused, nimble, and more experimental in their approach.

What are some key trends shaping the MedTech industry?

AI is moving into diagnostics. Care is shifting from hospitals to homes. Interoperability is becoming essential, and regulators now expect real-world clinical evidence, not just research papers.

How do MedTech startups secure funding for growth?

Most raise capital through venture firms, healthcare-specific funds, or strategic partners like hospitals and payers. Early grants or government innovation programs also help. But to grow, they need more than funding—they need regulatory traction, clinical validation, and adoption.

Are MedTech startups regulated?

Yes, and increasingly so. Devices and software that diagnose, monitor, or influence treatment typically fall under the FDA (in the U.S.) or MDR (in the EU). Digital health tools are also being scrutinized more. If you’re building or backing a MedTech startup, regulatory strategy has to be part of the roadmap from day one.

How does AI contribute to MedTech innovations?

AI helps make sense of complex data, imaging, genomics, and wearable inputs, faster and often more accurately than humans. It’s being used in radiology, pathology, triage, remote monitoring, and even drug development.

Which MedTech startup sectors are growing the fastest?

Remote monitoring, AI-assisted diagnostics, digital rehab, and precision oncology are leading. There’s also growing traction in hospital workflow automation and clinical decision support tools.

Conclusion

What makes this moment different is that the tools are finally catching up to the problems. AI can now support real clinical decisions. Hardware is portable and affordable. Providers are more open to integration, and regulation is starting to create lanes for innovation.

But healthcare is still complex. It doesn’t reward speed for its own sake. So, if you’re watching this space, whether as a clinician, builder, or investor, these companies are worth following. Not only because they’re growing but also because they’re solving problems that have been ignored for too long.

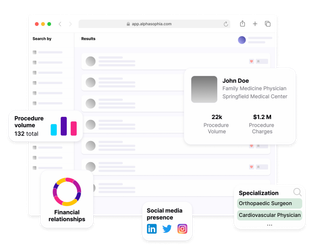

Speed Up Physician Outreach with Alpha Sophia