6 Healthcare Market Insights That Drive Smarter Investment Decisions

Most investors looking at healthcare make one of two mistakes. They either rely on generic indicators like broad aging trends, macro funding patterns, or “digital health” lexicon.

Or they get caught up in clinical jargon, regulatory complexity, fragmented delivery models, and fail to connect it back to value creation.

Both approaches fail.

What you actually need are structured, market-level insights that explain why things are shifting, where capital is being created, and how that maps to investable opportunity.

That’s what this article is about.

We’re going to walk through six market dynamics that every healthcare investor needs to internalize because they’re signals to underlying structural change in how care is delivered, paid for, and scaled. And each one carries real implications for where capital will compound over the next five years.

How Data-Driven Insights Help Investors Make Informed Decisions and Mitigate Risks

Every healthcare investor says they’re “data-driven.” But most are only working with surface-level information.

The real edge comes when you can see what’s actually changing beneath the surface, like clinical behaviors, payer incentives, adoption patterns, and policy movements, and tie those shifts to how value will be created or destroyed.

1. Data Replaces Narrative With Patterns

Data-driven insights cut through narrative and show you what’s actually happening. Whether private payers reimburse at higher rates for virtual models or if certain specialties are seeing faster clinical adoption of AI.

You will not find these patterns in earnings reports or founder decks. They’re in claims databases, peer-reviewed literature, market access logs, and operational metrics. That’s the level of insight required to invest with precision.

2. Diligence Starts Before the Call

Most due diligence happens too late after months of relationship building.

But with the right insights, you can disqualify bad deals early. You can know if a company’s TAM is overstated because procedure counts are falling in its core use case. You can know if their buyer persona is actually not a decision-maker.

And you can learn this before making a single call.

3. Understand How Decisions Are Made

Healthcare purchasing is messy. It’s not one buyer. It’s a web of clinical, administrative, and financial influence, often inside bureaucratic organizations.

Data tells you who performs procedures, who refers patients, who sits on formulary boards, and who publishes guidelines. That intelligence turns vague go-to-market plans into viable, scalable strategies.

4. Spot Signals Before They’re Obvious

Companies don’t “shop” for solutions like consumers, but they leave traces, such as research participation, hiring patterns, conference topics, and pilot program activity.

Data analytics can surface these micro-signals at scale, helping you identify inflection points before the market does.

6 Healthcare Market Insights For Smarter Investment Decisions

In healthcare, the difference between a good investment and a smart one is context. You don’t need to know everything. But you do need to know what’s changing structurally.

Real opportunities are found in system-level shifts that quietly rewire how care is delivered, who controls access, and where money flows next.

1. AI is Only Investable If It Solves A Systemic Bottleneck

The AI companies worth backing in the healthcare sector are the ones solving problems that can’t be solved through staffing, outsourcing, or manual effort. That means bottlenecks. Places where volume exceeds human capacity, where workflows break down, or where costs are too high to sustain.

For example, AI tools are being used to prioritize scan reviews, reducing time-to-read in high-volume settings in radiology. These are critical pressure points where AI delivers measurable ROI.

2. Value-Based Care Is The Pricing Mechanism

Everyone says they “support value-based care.” But most startups still build and sell like they’re in a fee-for-service world.

And that’s the problem. Because once you strip the jargon, value-based care simply means that buyers no longer get paid for doing more, they get paid for doing better. And that changes what they’re willing to buy, how they justify it, and what metrics matter.

For example, in a traditional model, a hospital gets paid every time a patient shows up. More tests mean more revenue. But in a value-based model, they are penalized if the same patient keeps coming back. More admissions mean poor performance.

So if you’re selling a solution that increases usage but doesn’t offset downstream cost, it’s not aligned. This is why so many digital health and AI companies stall post-pilot, because in value-based care, your customer’s margin is tied to performance.

3. Consolidation Controls Buying Decisions

It used to be simple. If you sold into a hospital, you figured out who used the product, who managed the department, and who signed the PO. Three people, maybe four.

That’s gone. Consolidation has changed the structure of healthcare delivery and, with it, the structure of decision-making. The buyer is no longer local, they’re regional and sometimes national.

And here’s where investors get it wrong. They evaluate commercial strategy based on clinical enthusiasm. They ask, “Do doctors want this?” when the better question is, “Can any doctor actually buy this?”

In a consolidated system, usage and purchase are separated. If your target buyer can’t influence the contract process, your sales cycle is dead.

That is why smart companies now map the organization chart before they sell. They identify who owns the budget, who owns the risk, and who influences both. And they design their value proposition for that path.

4. The Aging Population Is A Care Model Problem

Everyone flags aging as a macro driver. Few account for how it breaks the current system.

It’s not that more people are turning 75. It’s that we’re entering a decade where the fastest-growing patient segment also happens to be the most clinically complex, the most expensive to manage, and the least well-served by current infrastructure.

Most spending is shifting to home-based care and risk-bearing primary care models, which is where the margin and pressure now sit.

So, if you’re investing in a company that targets seniors, try to understand whether it works in the care environments that are actually absorbing this demand.

5. Reimbursement is an execution risk

Getting a code means nothing if payment is inconsistent, if documentation requirements are too high, or if payers constantly deny claims. That’s why so many diagnostics, devices, and digital health tools look good on paper, then fail commercially.

Reimbursement is not only coverage. It’s about:

- Who pays

- At what rate

- Under what conditions

- And how reliably

6. Real-world data is the new requirement

Clinical trials used to be the gold standard. They still are, but for regulatory approval.

For commercial success, buyers and payers increasingly want to see what happens after the trial, in the real world with real patients.

Payers want it for coverage decisions. Providers want it to justify switching. Pharma wants it to model downstream value. If a company can’t show proof in the wild, don’t expect the market to take their word for it.

FAQs

Why is healthcare an attractive sector for investors?

Because it sits at the intersection of non-cyclical demand, rising system inefficiency, and long-term demographic certainty. But the real reason is that it’s a system under pressure, and pressure creates opportunity when you understand where the cracks are forming.

What are the key factors investors should consider in healthcare investments?

Reimbursement dynamics, buyer structure, clinical workflow integration, real-world evidence requirements, and whether the company aligns with cost reduction or risk-bearing incentives. If you miss any of those, you’re not underwriting the actual risk.

How does value-based care impact healthcare investments?

It changes the purchase logic. Solutions are no longer evaluated on efficacy alone, they’re judged by whether they help the buyer succeed under performance-based contracts. That shift rewires the market.

What role does data analytics play in healthcare investment decisions?

Data is about pattern recognition. The ability to see where demand is aggregating, where friction is unsustainable, and where incentives are misaligned. That’s how you invest ahead of the curve.

Which healthcare sectors are experiencing the fastest growth?

The ones solving high-friction problems under cost pressure. Examples: virtual care models for complex populations, AI that replaces manual workflows, RCM automation, home-based care infrastructure, and MA-focused care delivery.

What are the risks of investing in healthcare organizations?

Misjudging reimbursement. Selling to the wrong buyer. Overestimating clinical adoption. Underestimating procurement timelines. And assuming that regulatory approval equals market success.

How can investors identify high-growth healthcare companies?

Look for companies solving painful problems for buyers operating under constraints. Then, check if they can scale within existing reimbursement or procurement channels. If they can, you have something real.

How does Alpha Sophia help investors make data-driven decisions?

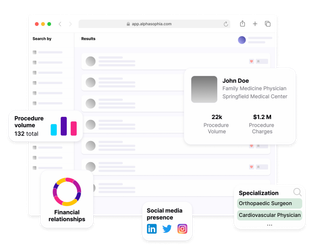

Alpha Sophia streamlines investment sourcing and due diligence by offering detailed provider profiles, including practice locations, medical specialties, state licenses, and affiliations.

Conclusion

The smartest capital in healthcare is tracking friction because that’s where change happens.

In places where cost is unsustainable, workflows break, or incentives shift faster than vendors can adapt.

Each of the six insights above points to one of those pressure zones. These zones are already shaping who gets paid, what gets adopted, and where the system opens up for new players.

Alpha Sophia to support data-driven investment