How Financial Investors Can Identify High-Growth Healthcare Providers & Organizations

If you’re an investor looking at the healthcare sector, you already know that healthcare is one of the biggest and most resilient industries out there.

People will always need medical care, treatments will continue to evolve,and demand continues to grow due to aging populations and rising chronic disease trends.

But not every healthcare provider or organization is a great investment.

It’s easy to assume that just because a healthcare company is growing in revenue, it’s a solid bet. That’s where a lot of investors go wrong.

The key to identifying high-growth healthcare providers and organizations is understanding the full picture. And that’s where healthcare data platforms and AI-driven analytics are changing reality.

This guide will walk you through how to assess healthcare investments with a critical, data-driven approach. You’ll learn which metrics matter, how to use technology to make smarter decisions, and why platforms like Alpha Sophia are making it easier than ever to identify high-growth opportunities in the healthcare sector.

Challenges Investors Face in Healthcare Sector Analysis

Unlike industries where financials alone tell a clear story, healthcare is layered with complexities that can make or break an investment. Investors who don’t dig deep often find themselves blindsided.

Here are the biggest challenges you’ll need to steer clear of when evaluating healthcare providers:

1. Regulatory Complexity Can Kill Profitability

The healthcare industry doesn’t operate like a free market. Governments, insurance companies, and policymakers dictate how money moves, and one regulation change can completely alter a company’s financial outlook.

2. Financial Data Alone Won’t Tell You the Full Story

Unlike a SaaS company, where metrics like revenue, churn rate, and user growth provide clear insights, healthcare organizations have more complex indicators of value. A hospital could show strong revenue growth but have dangerously high readmission rates, meaning it’s providing poor care and could soon face penalties.

If you’re just looking at financial reports and not operational performance, you’re missing half the picture.

3. Data is Scattered

One of the hardest parts of analyzing healthcare companies is that the data you need is fragmented. There’s financial data, patient outcome data, physician performance data, claims data, and referral data — and it’s rarely all in one place.

Without the right tools, it’s like trying to put together a puzzle with half the pieces missing.

4. Market Dynamics Shift Faster Than You Think

COVID-19 proved this in real time. Telehealth exploded while hospitals struggled with non-COVID patient volume.

Healthcare is also affected by demographic trends, as aging populations drive up demand for specialized care, while younger generations prefer digital-first healthcare experiences.

If you’re not tracking how these shifts impact a company’s business model, you could end up investing in something that’s already outdated.

5. The Labor Crisis is a Real Threat to Growth

It doesn’t matter how much demand there is for healthcare if there aren’t enough doctors, nurses, or skilled medical professionals to meet it.

Right now, healthcare is facing one of the worst labor shortages in history. High turnover rates, burnout, and staffing costs are major pain points.

6. Reimbursement Models Are Changing the Business of Healthcare

The old model of healthcare, where providers made money based on the number of services they performed, is fading. Now, value-based care is becoming the standard, meaning providers are reimbursed based on patient outcomes rather than service volume.

Investors who aren’t analyzing a company’s payor mix and reimbursement strategies could be stepping into a financial trap.

7. Cybersecurity Risks Are Growing

Healthcare organizations hold massive amounts of sensitive patient data, making them prime targets for cyberattacks. A major data breach can permanently damage a company’s reputation. As an investor, you need to look at how seriously a company takes cybersecurity.

Key Data-Driven Metrics for Evaluating High-Growth HCPs & HCOs

If you want to separate true high-growth healthcare companies from the ones that just look good on the surface, you need to focus on the right metrics because revenue growth alone isn’t enough.

You need to dig into operational, clinical, and network data to understand whether a healthcare provider is truly positioned for sustainable success. Here are the key metrics to look for:

1. Patient Health Outcomes (Quality of Care)

Patients today have more options than ever, and bad healthcare experiences drive them away.

Look for key indicators of strong patient outcomes like:

- Readmission rates

- Patient mortality rates

- Procedure success rates

Investors who ignore these metrics often end up backing providers that look good financially but have serious quality-of-care issues.

2. Patient Satisfaction & Retention

A healthcare organization can only grow if it keeps its patients. If people leave after one visit or give consistently poor feedback, future revenue will suffer.

Key metrics to track include:

- Net Promoter Score (NPS)

- Patient churn rate

- Online review scores

3. Cost Efficiency & Operating Margins

If costs are rising faster than revenue, growth is unsustainable. The financial indicators you should look for are:

- EBITDA margins

- Cost per patient visit

- Payor mix

4. Provider Network Strength & Referral Volume

If a provider has a weak referral network, it’s much harder to sustain long-term growth. You should watch for:

- Referral inflow

- Affiliation strength

- Physician retention

5. Scalability & Expansion Potential

A healthcare provider might be thriving in one location, but can its model scale? Look for signs that the provider has good growth potential:

- Multi-location performance consistency

- Technology-driven efficiencies

- Market demand alignment

6. Payor Reimbursement Risk

If a provider is heavily dependent on government reimbursement, it’s more vulnerable to policy changes.

Many investors overlook this, only to realize later that the company they backed is heavily exposed to reimbursement cuts.

Leveraging AI & Advanced Analytics for Smarter Investment Decisions

AI and advanced analytics are changing the way smart investors assess risk, identify high-growth providers, and predict long-term success.

Healthcare data is messy and scattered across financial reports, clinical performance records, insurance claims, and provider networks.

AI pulls in real-time insights from this data to reveal trends before they’re obvious. It can flag hospitals with rising readmission rates, detect shrinking referral networks, and predict how changes in reimbursement policies will impact profitability.

In a competitive industry such as healthcare, the difference between a great investment and a costly mistake often comes down to who has better data and how fast they act on it. AI gives investors that edge.

The Role Of Healthcare Data Platforms Like Alpha Sophia In Identifying Investment Opportunities

Financial reports tell one story, patient outcomes tell another, and operational efficiency is often buried beneath layers of fragmented information. Piecing them together is slow, inefficient, and prone to blind spots.

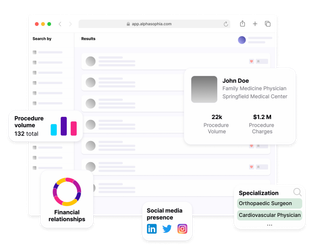

Today, AI-driven healthcare data platforms like Alpha Sophia make it possible to assess investment opportunities faster, more accurately, and with deeper insight.

Rather than pulling reports from multiple sources and trying to stitch them together, Alpha Sophia aggregates data from across the healthcare ecosystem so you can:

- Ensuring more informed decision-making

- Evaluate Market and competitive positioning

- Analyze growth potential of investment opportunities

This means you can instantly see which organizations are truly positioned for long-term growth and which ones look good on paper but carry hidden risks.

Strategic Investment Approaches in the Healthcare Market

The healthcare market isn’t like other industries. You can’t look at revenue growth and assume a company is a good investment. Regulations shift, reimbursement models change, and operational inefficiencies can eat into margins faster than you expect.

So, the best healthcare investment strategies are data-driven, risk-aware, and focused on long-term sustainability.

1. Use Data

You need to go beyond EBITDA and revenue numbers. Platforms like Alpha Sophia aggregate data across financials, patient trends, provider networks, and reimbursement risks, giving you a clearer picture of where an organization is headed.

2. Focus on Operational Strength

Some healthcare companies scale efficiently, while others expand too fast and collapse under inefficiencies. You need to analyze cost per patient, staff utilization, and payor mix to ensure growth is actually attainable.

3. Monitor Reimbursement & Regulatory Trends

You need to track Medicare adjustments, value-based care adoption, and reimbursement rate trends to stay ahead of risks.

4. Prioritize Scalable, Tech-Enabled Models

Healthcare providers adopting AI, telemedicine, and automated workflows tend to scale more efficiently than those relying on outdated systems. You should assess whether a provider is using technology to improve care and lower costs, not just as a marketing gimmick.

FAQs

Why is healthcare an attractive sector for financial investors?

Healthcare is recession-resistant, driven by aging populations, rising chronic diseases, and medical innovation. Demand is constant, making it a stable, long-term investment.

How can investors use healthcare data to mitigate risks?

Traditional financial reports miss red flags. AI-driven data platforms reveal patient trends, provider performance, and reimbursement risks, helping investors spot opportunities and avoid pitfalls early.

What role does Alpha Sophia play in healthcare investment decisions?

Alpha Sophia aggregates financial, operational, and market data, giving investors a clear, data-backed view of sustainable growth opportunities.

What are some emerging investment trends in healthcare?

Healthcare is moving toward tech-enabled care, with AI, telemedicine, and automation improving efficiency and scalability. Value-based care is replacing traditional fee-for-service models, tying reimbursement to patient outcomes.

How can investors identify healthcare organizations with strong M&A potential?

High-potential Mergers and Acquisition targets have efficient operations, scalable models, and strong provider networks. Key indicators include financial health, payor mix, and patient retention.

How does provider network data impact investment decisions?

A provider’s success depends on its position within the healthcare ecosystem. Strong networks drive patient volume, improve reimbursement rates, and ensure long-term stability.

Conclusion

Healthcare investing is high-reward, but only if you know where to look and what to avoid.

Revenue growth alone doesn’t mean a provider is a good investment. Operational inefficiencies, weak provider networks, or regulatory shifts can turn strong numbers into a failing business.

So, use data and insights to find risks and spot sustainable growth before it’s obvious. Alpha Sophia makes this process faster and smarter, giving you a clear, data-backed view of which healthcare organizations are built to last.

Stay Ahead Sophia to support data-driven investment