The Innovator’s Dilemma in Medical Device Sales: Why Great Products Sometimes Struggle

In the fast-evolving world of medtech, one of the biggest threats to established companies isn’t external—it’s internal. It’s called the Innovator’s Dilemma, and it explains why even the most successful medical device companies can fall behind when disruptive technologies enter the market.

Let’s break down what the Innovator’s Dilemma is, how it shows up in medical device sales, and what your team can do to avoid getting left behind.

🔍 What Is the Innovator’s Dilemma?

Coined by Clayton Christensen in his groundbreaking book The Innovator’s Dilemma, the term describes the paradox where large, successful companies fail to adopt new technologies—not because they aren’t aware of them, but because those innovations initially serve smaller, less profitable markets.

In other words: the very focus on serving existing customers well can blind companies to disruptive innovation.

Disruptors typically start small—offering simpler, cheaper, or more accessible solutions. Over time, they improve their offering and move upmarket, displacing incumbents who waited too long to adapt.

⚠️ How It Applies to Medical Device Sales

The Innovator’s Dilemma plays out clearly in medical device commercialization, especially for companies selling into hospitals, health systems, and surgical networks.

Here’s how:

1. Sales Teams Are Incentivized to Sell What’s Proven

Most medtech reps are compensated on sales volume and quotas, which naturally biases them toward selling products that already have:

- High reimbursement rates

- Established buying centers

- Existing KOL (Key Opinion Leader) support

New, disruptive devices often don’t have those things—yet. So reps are hesitant to spend time on them.

✅ Example: A new wearable cardiac monitor that offers better compliance may get ignored in favor of the legacy Holter monitor because the billing and workflow are already in place.

2. Procurement & Clinical Teams Are Risk-Averse

Hospitals and IDNs often favor incremental improvement over transformation, due to:

- Budget cycles

- Implementation complexity

- Fear of disrupting clinical workflows

This means new innovations—especially those that change care models (e.g., remote monitoring, AI-driven triage)—face an uphill battle, regardless of clinical value.

For context, STAT reported in 2022 reported in 2023 that only 7% of health tech innovations make it past the pilot phase in hospitals.

3. Disruptors Start Where Incumbents Aren’t Looking

Disruptive medical devices often enter underserved markets—like outpatient clinics, ambulatory surgery centers, or home-based care—before growing into mainstream hospital use.

✅ Example: Exablate Neuro, a focused ultrasound platform for treating essential tremor, started as a niche tool but is now making waves in neurosurgery, threatening legacy DBS systems.

💡 What Can Be Done?

Facing the Innovator’s Dilemma doesn’t mean you’re doomed. Here’s how medical device companies can protect themselves while embracing innovation:

✅ 1. Create Separate Sales Channels for Emerging Products

Rather than forcing your legacy sales team to also sell the new thing, consider building a dedicated commercialization team for disruptive technologies. These reps are incentivized differently, often with longer runway KPIs.

This is a model used by companies like Medtronic, who built specific teams for digital health and AI-integrated tools.

✅ 2. Invest in Education and Workflow Integration

New technology must fit into the clinical workflow and be reimbursed to gain traction. Provide:

- CPT code guidance

- Economic impact models

- Case studies or peer-reviewed studies to support adoption

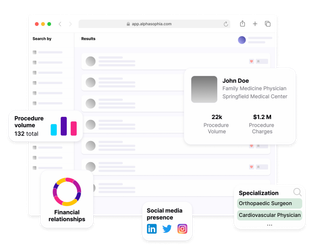

Back this up with claims data and procedural analytics from platforms like [Alpha Sophia]/) or Definitive Healthcare.

✅ 3. Partner with Early-Adopter KOLs

Work with forward-thinking physicians who value innovation and are willing to pilot new devices. These physicians often publish and speak publicly—making them valuable evangelists.

Not sure where to find them? Use open payments data and procedure volume data to identify who is already pushing boundaries.

✅ 4. Don’t Underserve the Bottom of the Market

Even if a disruptive device doesn’t appeal to your top 100 hospitals today, it might be perfect for ASCs, rural hospitals, or global markets.

That’s where disruptors thrive—and where incumbent device makers can get caught flat-footed.

🚀 Final Thoughts

The Innovator’s Dilemma isn’t just theory — it’s a real risk for medical device companies focused only on what sells today. The key is to balance the core business with a dedicated strategy for emerging technologies.

If you’re a medtech sales leader or marketer, ask yourself:

- What innovation are we ignoring today that could change the game tomorrow?

- Are we giving it a fair shot—or protecting our existing revenue?

The companies that thrive are the ones that embrace change before it’s forced on them.

Accelerate product adoption with Alpha Sophia