How to Identify Market Gaps in Healthcare Using Healthcare Market Research

You can launch the perfect product and still go nowhere if the market doesn’t need it. That’s the uncomfortable truth in healthcare.

It doesn’t matter how good your tech is. It doesn’t matter how many hours you spent on the clinical workflow. If it’s not solving a real, visible problem, one that providers, payers, or patients are actively struggling with, it will sit unused.

And that’s where most healthcare companies go wrong. They build for what could be valuable, not what is missing. That’s what this article is about.

We’ll start with what market gaps in healthcare look like. Then we’ll walk you through exactly how healthcare market research helps you identify them.

Understanding Market Gaps in Healthcare

Most healthcare companies define a market gap as “a space with unmet needs.” But that definition, while technically accurate, isn’t particularly useful.

In healthcare, almost every segment has some level of unmet need. The real question is whether that need is actionable, specific, and currently underserved in a way that creates a business opportunity.

A useful way to think about market gaps is to look at the point where three things intersect:

- A recurring operational or clinical problem that has a measurable impact on outcomes, cost, or time.

- A segment of the market that experiences this problem frequently enough for it to matter.

- A lack of viable solutions that address the problem effectively, at scale.

When these three conditions are met, you have a market opportunity.

Take, for example, the rollout of remote monitoring programs for chronic care. Devices are available, and data can be collected. Yet usage rates among elderly patients remain low. That’s not because there is no need for it, it’s because the solution hasn’t accounted for digital literacy, caregiver involvement, or the incentive structure of primary care providers.

These kinds of gaps exist at every level of the healthcare system. Some are clinical, some are operational. But what they have in common is that they represent demand that hasn’t been met in a way that aligns with how healthcare actually works.

How to Identify Market Gaps in Healthcare Using Healthcare Market Research

If there’s one thing most healthcare companies underestimate, it’s how difficult it is to tell the difference between a real market gap and a temporary inefficiency.

A problem in the system doesn’t automatically translate to a viable opportunity. Plenty of things are broken in healthcare. That doesn’t mean every broken thing is worth solving or solvable through a commercial solution.

That’s why you need ground-up, structured research designed to answer a very specific question. Such research needs to be layered. You can’t rely on one source, one stakeholder group, or one research method.

You need to understand how the problem manifests clinically, operationally, financially, and politically, because all four affect whether the market is actually addressable.

Identify Who Owns The Problem

The starting point is always stakeholder-level understanding. Not only who experiences the problem, but also who owns it. In healthcare, the person most frustrated by an issue often isn’t the person who controls the budget to fix it.

That’s why you see situations where nursing teams are burned out from broken discharge processes, but the solution needs to be justified to an executive team that’s thinking in terms of readmission rates and CMS penalties.

If you don’t agree with the person who owns the KPI, the problem may be real, but it will not be prioritized.

Understand The Context Along With The Pain Points

Once you know who owns the problem, the next layer is understanding context. This is where most surface-level research stops short.

It’s not enough to know that a workflow is inefficient. You need to understand whether that inefficiency is systemic or solvable.

For example, a referral coordination tool may make sense on paper until you find out that most of the target clinics don’t have the staffing to operate it. Or that the downstream providers aren’t in-network. Or that the patient population doesn’t respond well to digital nudges.

That’s the reality your solution has to fit into.

Study Where Others Have Failed And Why

Next, you want to look for evidence of failed adoption. If you see that multiple vendors have entered a space but failed to gain traction, you need to look deeper.

Many companies walk away from these spaces too early. They assume that if others fail, the opportunity is not worth it. In healthcare, the opposite is often true.

A market that’s filled with underperforming solutions is sometimes the strongest signal that a real problem exists, but that no one’s solved for the actual constraint yet.

Confirm Whether The Economics Support The Action

Finally, you need to test whether the economics hold up. That means looking at whether the organization has a reason to act.

If there is no reimbursement, quality metric, financial penalty, or pressure from patients or regulators, the problem might persist, but no one will pay to solve it.

That doesn’t mean the issue doesn’t matter. But if there’s no clear budget owner or policy trigger, it likely won’t be prioritized.

FAQs

What is a market gap in healthcare?

A market gap in healthcare is a recurring, high-impact problem that remains unaddressed or poorly solved by existing solutions. It usually shows up in areas where outcomes are suboptimal, costs are avoidable, or workflows are broken, despite the presence of tools, funding, or policy.

Why is identifying market gaps important for healthcare businesses?

Because most failed healthcare products are just misaligned with real-world needs. If you build for a problem that’s already being solved effectively, or one that no stakeholder owns, you’ll struggle to gain traction. Identifying genuine market gaps gives you a clearer path to adoption, reimbursement, and scale.

How can market research help in identifying healthcare market gaps?

Market research shows you what’s missing and why it’s missing. When done properly, it reveals how problems are currently managed, what the operational constraints are, who is responsible for change, and why existing solutions haven’t stuck.

What are some examples of market gaps in healthcare?

Some of the most persistent gaps exist in areas like post-acute care coordination, behavioral health integration, rural specialty access, and chronic care for underserved populations. In many cases, partial solutions exist, but adoption is poor, or outcomes haven’t improved. That’s often because the tools don’t align with workflows, incentives, or infrastructure realities.

How does competitor analysis help in finding market gaps?

Competitor analysis is useful not to avoid crowded spaces, but to understand why current players haven’t solved the problem well. If a competitor has low adoption, that’s a signal to investigate, not to exit. Every failed product leaves behind insight about what not to do and where opportunity still exists, if approached differently.

What data sources are useful for identifying market gaps?

Claims data, procedure volumes, EMR usage patterns, staffing ratios, licensing and credentialing databases, reimbursement policies, regulatory filings, failed RFPs, product adoption curves, and stakeholder interviews. Quantitative data tells you where the friction is. Qualitative data tells you why it hasn’t been fixed.

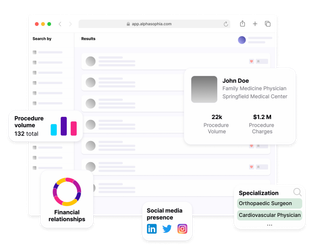

How can Alpha Sophia help in identifying market gaps?

Alpha Sophia provides healthcare organizations with access to data on healthcare professionals, institutions, and procedure patterns, which makes segmentation, targeting, and opportunity analysis significantly more precise. If you’re looking to identify where solutions are failing, who is underserved, and what kind of provider or organization is most likely to act, Alpha Sophia helps shorten that path.

Conclusion

It’s easy to talk about innovation in healthcare. It’s harder to place it in the right context. That’s what market gap identification is really about.

Surface-level market research can tell you which segments are growing. But it won’t tell you why competitors are failing, why adoption is stalling, or where the actual resistance sits inside an organization.

That kind of clarity only comes from research that’s designed to mirror how healthcare operates, in a cross-functional, politically constrained, financially sensitive, and deeply variable context.

Identify Market Gaps using Alpha Sophia