Why Private Insurers Dominate U.S. Healthcare and What it Means for MedTech

The recent shooting of the UnitedHealthcare CEO, Brian Thompson has intensified public scrutiny of private insurers and their role in the U.S. healthcare system. Often regarded as a “necessary evil,” these insurers wield enormous influence over healthcare access, reimbursement policies, and practitioner networks. For MedTech companies, understanding the dynamics of a consolidating health insurance market is essential to thrive in this complex environment.

Top 10 health insurers in the U.S. at the national level (2014 and 2023)

The American Medical Association’s (AMA) latest report provides a comprehensive overview of the largest health insurers in the United States and their market share over time:

| Insurers | Market Share 2014 (%) | Insurers | Market Share 2023 (%) |

|---|---|---|---|

| UnitedHealth Group | 16 | UnitedHealth Group | 15 |

| Anthem | 13 | Elevance Health | 12 |

| Aetna | 11 | CVS (Aetna) | 12 |

| Cigna | 8 | Cigna | 11 |

| HCSC (BCBS) | 6 | HCSC (BCBS) | 7 |

| Kaiser | 5 | Kaiser | 7 |

| BCBS MI | 2 | BCBS FL | 2 |

| Humana | 2 | BCBS MI | 2 |

| BCBS FL | 2 | Centene | 2 |

| BS of CA | 2 | BS of CA | 2 |

Source: American Medical Association - Competition in Health Insurance Report (2024 edition)

While the chart shows stable percentages, it doesn’t capture the full picture of consolidation in the healthcare insurance market. Health insurance markets are largely local, and national market shares often mask higher levels of concentration at state and metropolitan levels. According to the 2024 edition of the American Medical Association’s Competition in Health Insurance: A Comprehensive Study of U.S. Markets (PDF), 95% of Metropolitan Statistical Areas are highly concentrated, with BCBS insurers leading in 83% of MSAs. Mergers like the 2018 merger between CVS Health and Aetna, worth $70 billion, further highlight this consolidation.

Key insights for MedTech companies

1. Market Consolidation Continues

The combined market share of the largest insurers remains substantial, with UnitedHealth Group, Elevance Health, CVS (Aetna), Cigna, and HCSC (BCBS) dominating the market. For MedTech companies, this concentration means fewer decision-makers hold greater influence over reimbursement policies and provider networks. Building relationships with these insurers is critical to gaining market access.

2. Regional Variations Still Matter

While a few players dominate the national market, their influence varies regionally. For example, Blue Cross Blue Shield (BCBS) organizations have a strong local presence in several states. MedTech companies must tailor their strategies to address both national and regional dynamics.

3. Reimbursement Challenges and Opportunities

Consolidation often leads to stricter reimbursement policies and standardized criteria for product adoption. MedTech companies must position their products as solutions that align with these insurers’ cost-reduction and patient-outcome goals.

What this means for MedTech sales and marketing

Strategic Targeting

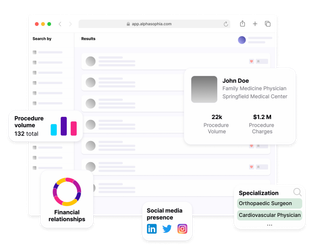

With fewer dominant insurers, MedTech companies must strategically target healthcare practitioners affiliated with these key players. Data-driven platforms like Alpha Sophia can help identify high-value practitioners and sites of care based on billing trends, location, affiliations, procedure volumes, and more.

Value-Based Selling

The dominance of insurers like UnitedHealth Group, Elevance Health, and CVS Health means MedTech companies must emphasize how their products contribute to cost savings, efficiency, and improved patient outcomes. Highlighting these benefits can accelerate adoption in competitive markets.

Localized Outreach

Regional variations in insurer influence require localized sales strategies. For example, a MedTech company targeting practitioners in California might prioritize Blue Shield of California, while those in Michigan might focus on BCBS MI. Tailoring outreach to local dynamics ensures more effective engagement.

Opportunities for MedTech companies

1. Focus on High-Value Practitioners

Use analytics to identify practitioners who perform high volumes of relevant procedures and are affiliated with dominant insurers. By concentrating efforts on these individuals, you can maximize sales efficiency.

2. Collaborate with Insurers

Explore partnerships with major insurers to demonstrate how your products align with their goals, such as reducing hospital readmissions or improving outcomes in value-based care programs.

3. Leverage Integrated Insights for Strategic Targeting

Combine claims data and Open Payments (Sunshine Act) data, to gain a full view of high-value practitioners and their affiliations. Alpha Sophia integrates these insights to enable precise targeting and data-driven strategies, offering a unique competitive advantage for smaller manufacturers navigating complex payer and provider dynamics.

4. Stay Ahead of Market Trends

Monitor changes in market dynamics to track practitioner behavior, competitive benchmarks, and regional variations. Proactive adaptation ensures your strategy stays relevant.

Conclusion

The consolidation of health insurance markets poses unique challenges for MedTech companies but also offers opportunities to refine and optimize strategies. By understanding the dynamics of these markets and leveraging data-driven tools like Alpha Sophia, MedTech leaders can navigate complexity, drive adoption, and achieve growth in a competitive environment.

Navigate healthcare market complexities with Alpha Sophia